(2017), “Bridging infrastructure gaps: Has the world made progress?”, McKinsey Global Institute. OECD (2022), OECD Economic Surveys: Mexico 2022, OECD Publishing, Paris. Improving business regulations at state and municipal, which in some instances remain costly and complex, would also help by facilitating firms creation and growth. Turning these opportunities into realities would require providing investors, both domestic and foreign, with certainty about existing contracts and with regulatory stability. Nearshoring trends, by which companies are likely to seek reducing supply chain disruptions risks by locating closer to their final markets, also provide Mexico with historic opportunities. The potential for investment to restart vigorously is high, spurred by the updated trade agreement and the strong recovery in the United States. Uncertainty particularly increased following proposals to reform the electricity market. Private investment has been hindered by high uncertainty about domestic policy settings. Conducting rigorous and transparent cost-benefit analysis would ensure sound project selection and help to respond to public investment needs in a cost-effective manner. A gradual increase in tax revenues would help to respond to public investment needs and strengthen the recovery, while maintaining the commitment with fiscal sustainability. For example, the increase in public investment needed to close the infrastructure gap in Mexico was estimated to be 1.3 percentage points of GDP a year ((Woetzel et al., 2017). Gaps in infrastructure remain also significant. The pandemic has exacerbated public investment needs, as the health and education systems are strained. But this has been largely achieved by cutting spending, particularly public investment. Mexico has been fiscally prudent over the years, broadly meeting its fiscal targets and ensuring fiscal sustainability despite having the lowest tax-to-GDP ratio in the OECD, at only 16% of GDP. The new Economic Survey of Mexicoargues that there is room to create better conditions for both public and private investment. Nonetheless, given that economic growth has averaged less than 2.5 over the past three decades, it is hard to foresee an acceleration from the anticipated 1.6.

Gross fixed capital formation, index, 2015Q1 = 100 Source: OECD Economic Outlook database

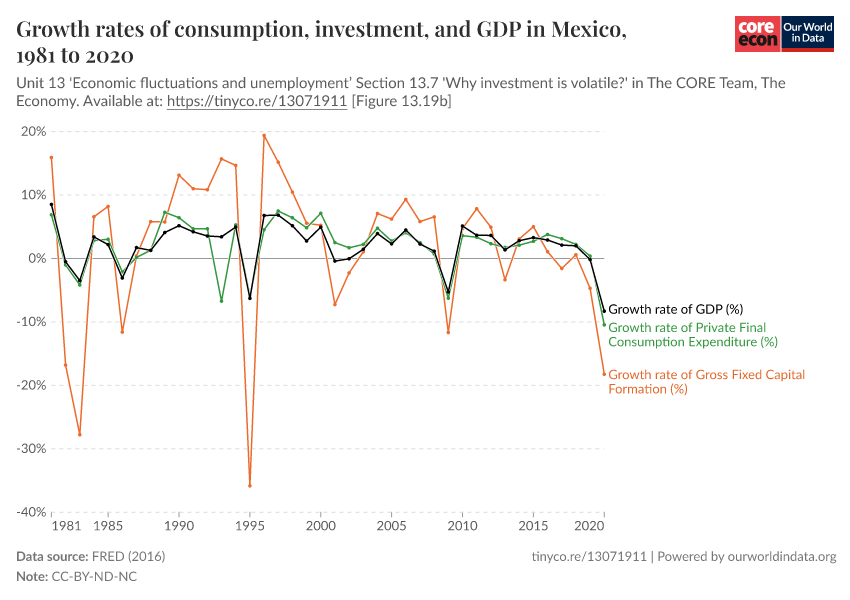

Investment has been muted since 2015 and falling since 2019 (Figure 1). However, a key pending challenge for Mexico is to revive investment. With an increasing share of the population vaccinated and the gradual improvement in the labour market, consumption will also be a key growth driver. Exports will continue to benefit from strong growth in the United States. The economy is expected to grow by 2.3% this year and by 2.6% in 2023. Mexico is gradually recovering from the pandemic-induced recession. By Alberto González Pandiella and Alessandro Maravalle, OECD Economics Department

0 kommentar(er)

0 kommentar(er)